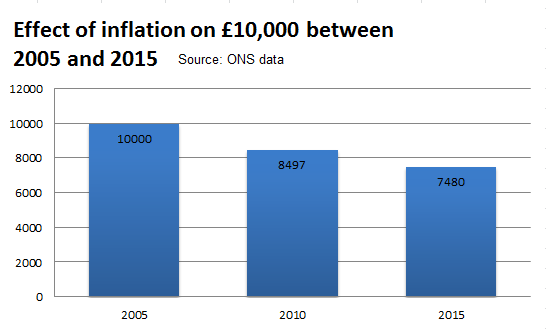

Savings rates are depressingly low. And have been for years. In terms of spending power your savings may actually be decreasing. And last month's decision by the European Central Bank to leave interest rates on hold isn't going to help. Here's why.

With interest rates at historic lows, savings rates have struggled to keep pace with inflation. Savers would have needed a 3.9% interest rate over the last five years to beat inflation. And many of us have not been getting near this rate. Are there other options?

While it's tempting to leave your money in a 'risk-free' savings account, the value of your capital in real terms may be falling. There are things you can do to try to beat inflation. And maintain the buying power of your money. One option you may wish to consider is investing. Over the medium to long term - 6 years or more - investments offer potentially greater returns than fixed rate savings accounts.

Before you invest, there are a few things to consider. Such as:

- Do you have spare money that you could afford to invest?

- Could you afford to tie up your money for 6 years or more? To ride out ups and downs in the market

- What is your attitude to risk? You would need to choose investments at a level of risk you are comfortable with.

A professional financial adviser can help you to answer these questions. And others. They will be able to tell you if investing is right for you, and your personal circumstances. Your adviser should have plenty of financial planning and investment experience. They can also help you to invest in a way that suits you.

Our advisers believe in a realistic, long-term approach to investments based on mutual trust. And your attitude to risk. We explain your options to you carefully and make sure that you are comfortable with any decisions you make.

Click here to send us an enquiry – without obligation

Or contact one of our European offices to speak to an adviser

You should bear in mind that the value and prices of investments can go down as well as up, and you may not get back the full amount invested.