Saving some of your salary? Each month? Would you say yes to extra money from the government? There may be tax incentives for retirement savings in the country you live. Providing you with additional funds to save or invest in your future.

Many countries offer tax incentives for retirement savings. The value of the incentive will differ from country to country. However, it's worth finding out what's available to you. It could increase the amount of money you save significantly. You may also wish to speak to a qualified financial adviser who has knowledge and experience of retirement planning where you live.

Example of national tax incentive for retirement savings

To give you an idea of how local tax incentives can benefit you financially, here's an example from Spain…

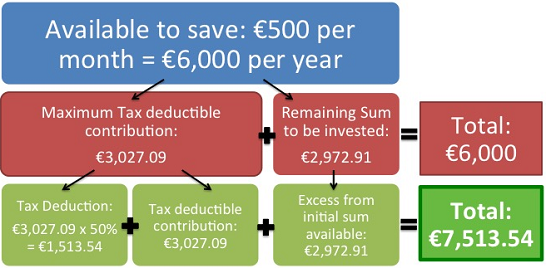

A self-employed person earning €5000 gross per month - and saving around €500 a month - wants to look into their retirement planning options. Assuming they pay the corresponding social contribution each year, they can contribute up to €3027.09 per year to their retirement fund. Deductible from their reported income. With a tax rate of 50% - Belgian taxes are high - they could save an extra €1513 per year.

Let's take a look at how this could affect the total value of their pension fund over time:

The additional €1,513 per year could be worth approximately €60,000 if it is invested for 25 years at an average rate of return of 5%.

The tax incentives in the country you live are probably different. To make sure you take full advantage of any incentives on offer, find out about taxation policy for retirement savings where you live. Or speak to a qualified financial adviser.

We have offices in nine European countries and can advise you on retirement planning and local taxation policy.

Click here to send us an enquiry – without obligation >

Or contact one of our European offices to speak to an adviser >

The tax rates and pension savings amounts in this article were correct at the time of writing. However, they may change in future and will vary depending on your personal circumstances.